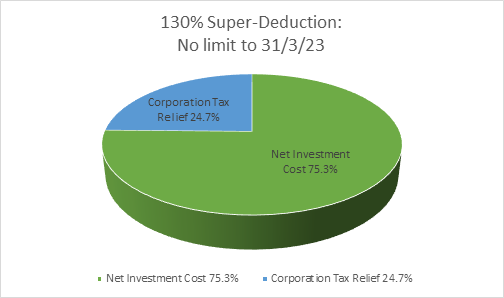

Super-Deduction is still available! until end of March 2023

As a result of the measures announced in the 2021 Budget, businesses have benefited from four significant capital allowance measures – Super-Deduction is one of them!

With a 11.6% reduction in business investment between Q3 ’19 and Q3 ’20 it comes as no surprise that the government introduced the super-deduction to give companies a strong incentive to bring planned investments forward and even make additional investments.

According to gov.uk “The government has offered unprecedented support for businesses during Covid. Even so, pandemic-related economic shocks and the accompanying uncertainty have chilled business investment. This super-deduction will encourage firms to invest in productivity-enhancing plant and machinery assets that will help them grow, and to make those investments now”

Click here for guidance

Valid from: 1st April 2021 – 31 March 2023

Relief: 130% no limit

• For companies only

• New Assets – plant and machinery only

• £10,000 expenditure = £13,000 deduction against profits

• £2,470 saving

Examples of the super-deduction in practice

Example one

• A company incurring £1m of qualifying expenditure decides to claim the super-deduction

• Spending £1m on qualifying investments will mean the company can deduct £1.3m (130% of the initial investment) in computing its taxable profits

• Deducting £1.3m from taxable profits will save the company up to 19% of that – or £247,000 – on its corporation tax bill.

Example two

|

Previous System |

With Super-Deduction |

|

· A company spends £10m on qualifying assets · Deducts £1m using the AIA in year 1, leaving £9m · Deducts £1.62m using WDAs at 18%

· Deductions total £2.62m – and a tax saving of 19% x £2.62m = £497,800 |

· The same company spends £10m on qualifying assets · Deducts £13m using the super-deduction in year 1

· Receives a tax saving of 19% x £13m = £2.47m

|

What is plant and machinery?

Most tangible NEW capital assets used in the course of business are considered plant and machinery for the purposes of claiming capital allowances. There is not an exhaustive list of plant and machinery assets. The kinds of assets which may qualify for the Super-Deduction include but are not limited to:

• Solar panels

• Computer equipment & servers

• Tractors, lorries & vans

• Ladders, drills & cranes

• Office chairs & desks

• Electric vehicle charge points

• Refrigeration units

• Compressors

• Foundry equipment

•

You can get the full Eligibility criteria which are outlined in the published tax information and impacts note HERE